I’m currently re-reading “One up on wall street” by Peter Lynch (must-recommended if you want to learn stock market investing). And a statement there fascinated me.

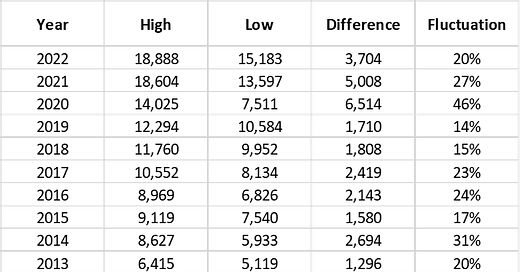

Peter mentioned something about the average stock fluctuation every year. And I was intrigued to see how true it was. So our team did an analysis of Nifty 50 for the last 23 years (January 2000 till December 2022). We captured the yearly high and low for each year, and calculated the fluctuation* between both.

Here’s what was fascinating - In 19 years out of the 23 years, Nifty’s fluctuation was greater than 20%!

This means that in a majority of the years after 2000 the Nifty has fluctuated by 20% or more (either risen or fallen)

So what does this mean?

All the sensational news that you read in the papers, about “Stock market fell by 5%” or “market 15% down from yearly high” is just that - sensational news. In the past 23 years, 82% of the times there has been a 20% or more fluctuation in the Nifty values. And given the fact that our equity market is doing well, I’d say this is pretty normal!

In fact, the fluctuation between a yearly high and yearly low has been as much as 65%, in 2008! And the average fluctuation over the last 20 years has been between 32-54% (which is what Peter Lynch also says). So don’t worry about the markets falling by 5, 10, 15 or even 20% in any given year. That’s how it has always been, historically.

Now a lot of people are worried about investing when the market is at a high value. But here’s what’s interesting - from the year 2000 onwards, no matter when you bought a Nifty Index fund and at what value, if you held it for 6 years or more, you would have been able to sell it and get a positive return. And 65% of the times, the CAGR would have been > 10%.

The point is, if you’re in it for the long term, it honestly doesn’t matter if you invest at an all-time high or if you see your portfolio dropping to even 50% of its value. It’s just been that way historically. The idea is to keep a minimum horizon of at least 5 to 7 years if you’re investing in the stock market, and you’ll be sorted!

But is it practically possible to not think about it for 7 years?

It isn’t.

Which is why, irrespective of your age or risk-taking ability, at any given time, you MUST have

an emergency fund and

decent savings in debt (bonds, FD, alternate assets, liquid funds)

It’s a myth that younger folks should invest more money in equity. If you have expenses lined up for the next 1 to 5 years, make sure you have some money in debt products too, so that you don’t need to withdraw your money at a loss if the stock market has fallen.

(If you’re looking to invest in bonds, we’ve partnered with a few companies to offer A-rated bonds to our subscribers. Check them out HERE)

Want to read about business and startups?

I’m as passionate about startups as I am about finance, so I’ve started writing about business and startups on this new platform called Tealfeed. There too, I write once a week, so if you’d like to read about innovative revenue streams, startups and business models in general, have a look at the content HERE and make sure you subscribe to it!

I promise to keep it as insightful as this newsletter 😁

Oh, and if you noticed, today’s newsletter didn’t come on a Sunday. I’m just experimenting with different days of the week to see which ones get the best views. Why don’t you write back and let me know if you’d like to read these articles on a Sunday or on weekdays? I’d love to interact with you guys!

Until next week, adios!

* Note that the fluctuation percentage is calculated keeping the “yearly high” as the base. The percentage would be higher if we take “yearly low” as the base.

I’m 40 and never managed to learn about money, let alone stock market and investments. Only lately I started appreciating it and I have some favorites in the space now like Zerodha Smallcase. What you wrote here is very motivational for people like me.