Well, as someone who writes on personal finance, I’ve said time and again that diversification is important.

(For the uninitiated, diversification means not having all your eggs in one basket - it means having a wide range of investments - in stocks, gold, mutual funds, real estate etc)

But what if I told you that all you need is mutual funds?

Well, if you just invest in mutual funds, diversification is taken care of. And let’s see why!

First, why do we diversify?

To reduce risk - if one product (known as asset class) does poorly, the other will come to your rescue. For example, if the stock market is down, your gold investment may help you make money

So that you have different products for different time horizons. Equity is used for a longer timeframe, while FDs can be used for as low as 6 months too! So depending on when you’d want your returns, you can choose the relevant product to invest in

To experiment with different kinds of products - some are low risk but stable, while others are high risk and (maybe) unstable. If you diversify, you can experiment with a wide spectrum of products, and maybe earn higher returns on some of them

While there are other reasons too, primarily, we diversify our investment due to the 3 reasons given above.

Now let’s see how mutual funds help with the above three points

But how do mutual funds help in diversification?

Let’s take #1 first (of course, we’ll go step-by-step 😉). We diversify because we want to reduce risk. And in mutual funds, there are various options - you have equity funds, debt funds, hybrid funds, real estate funds and even gold funds! So if you’ve invested in, say, equity and gold, if the stock market is down, your equity MF may be down, but your gold MF could help! And your liquid fund will give you the required stability in any case. So instead of hunting for different kinds of products and evaluating them, we can just look at different types of mutual funds

Next, we diversify so that we have products catering to different time horizons. Well, like I said, mutual funds provide options like liquid funds, which you can invest in with a time horizon of a few weeks, to small cap funds that will need more than 5-7 to give returns. So MFs take care of this too!

Lastly and more importantly - we diversify so that we can get a chance to make higher returns.

And here’s the thing - mutual funds can give you returns right from 5% all the way till 30%!

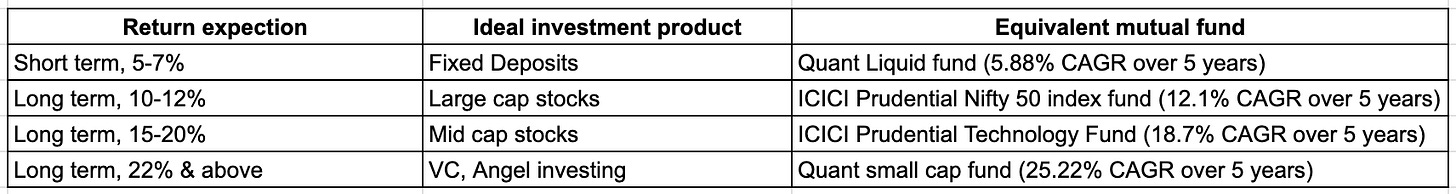

Don’t believe me? Let’s look at a few investment products below, and I’ll show you an equivalent mutual fund for it!

You see, for every kind of return that you want to make, for every kind of asset class that you invest in, there is a mutual fund that gives an equivalent return.

Why then, would you want to invest in products apart from mutual funds?

Let’s look at each of the above products with a reason (apart from returns) that you’d want to invest in them:

Fixed Deposit → Short term, 5-7% return: You should invest in FDs if you’re looking for guaranteed, fixed return. Liquid funds, while they’re safe from a capital protection perspective, also fluctuate when interest rates change. But most liquid funds are short term ones, so that’s not a major concern. However, data shows that FDs are currently giving better returns than liquid funds (but that’s also because interest rates are high right now)

Large cap stocks → Long term, 10-12% return: Here, if you can pick winners like HDFC, Bajaj etc, then go ahead with investing in large cap stocks. Else if you’re after average companies, you’re better off investing in an index fund

Mid cap stocks → Long term, 15-20% return: Again, the average return that a mid-cap stock delivers can easily be delivered by a sectoral fund like ICICI Prudential Technology fund or a mid/small cap mutual fund. If you’re good at picking stocks, you can get great returns from mid-caps/small caps. But if you don’t understand stocks, you’re better off choosing a nice mutual fund (which an advisor can help you with)

Angel investing → (Super) Long term, 22% + return: Well, let’s talk about the nuances here. Angel/VC investing is super risky. And for what? Out of 10 startups you’d invest in as an angel, at least 7-8 would fail. The few that succeed, will cover up for the rest. But that means your average return would be between 22-30%. Why take up all the effort to understand the space, invest in at least 10 startups and then wait for 10+ years, only to get returns that a Quant small cap fund could give you? 😂

Okay jokes apart, startup investing, for a lot of investors, is less about returns and more about the thrill. Go ahead and do it if you want to experience it. But it’s one of the riskiest modes out there, so be prepared that you may lose all your money.

Well, that’s about it. Today’s post was to tell you how mutual funds can actually help you make returns that are equivalent to almost all asset classes out there. But that doesn’t mean you should only invest in mutual funds. I’d be happier if you have a portfolio with multiple asset classes, but if you don’t understand them and don’t have the time to understand them, mutual funds will do all of it for you!

If you liked this piece, please write back to me on this email, I’d love to hear from you guys!

Oh, and also share this with friends! We’re at 10,200+ subscribers now! So thank you for making this happen, and keep sharing!