Hey there!

So by now, you would know that the budget is out, and that the new tax slabs are revised.

Today, I’m sharing an excel sheet that’ll tell you which regime works better for you. You just need to input your salary details, and the excel will give you your tax liability for both regimes.

If you want to have a look at the excel, jump to it at the end of the article.

If you want to know about the changes, keep reading!

So what’s changed?

Well, there were two regimes even until this year - Old and New.

The old regime stays the way it is. The new regime has been revised (should we call it new-new regime now? 😛)

Okay, sorry for the bad joke. Moving on..

In the old regime, you can claim exemptions and deductions. In the new regime, you can’t.

In the old regime, there’s no tax for income up to Rs. 5 lakhs. In the new regime, there’s no tax for income up to Rs. 7 lakhs

Standard Deduction of Rs. 50,000 can be claimed in both regimes

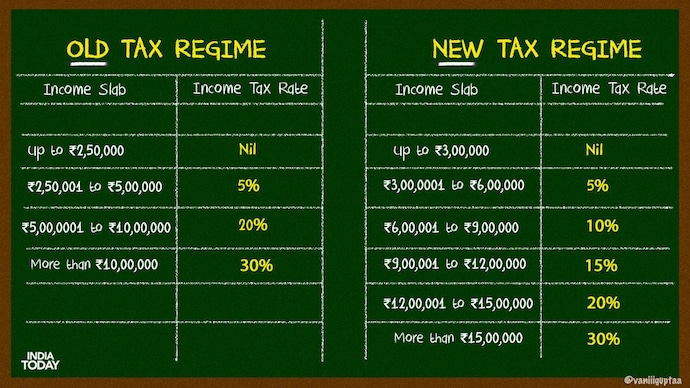

Below are the tax slabs for both regimes:

Honestly, I think a lot has been said on social media about both regimes, so I won’t get into details here. As per my analysis, if you have an income of over 12-15 lakhs, only then is the new regime beneficial for you. Else you’re better off with the old regime itself.

The link for the excel sheet is given below.

Related links

As promised, HERE is the excel sheet. You won’t be able to edit the sheet, but you can download it directly from “File” in the menu

Once you’re done checking the excel, please give me 15 seconds - I’m exploring what products I can build for a wonderful audience like you (we’re at 9,000+ subscribers now!). But for that, I need some basic details from you HERE. If you haven’t done it already, it would mean the world to me if you could share your basic details - Won’t take more than 15 seconds, I promise. And it’s completely anonymous!

Let me know if today’s newsletter helped! And feel free to reach out to me in case of questions!

See you on Sunday! Have a lovely weekend! 😁

No standard deduction available in new tax regime if Income < 15.5 lacs