The daunting credit card trap! 🤯

If you and I are connected on LinkedIn, you’ll know that I’m a huge fan of credit cards (if we’re not, then let’s connect HERE)

But that comes with a catch.

I love them only because I get rewards and points. Not because I get credit.

You see, the day I start depending on credit cards for my spends, will be the day I’ve thoroughly messed up my finances.

And the reason I say that, is because not making a full payment by the due date is a disaster.

If you, like me, have missed making a payment for whatever reason, you would know how bad it feels to see that “Interest charge” on your credit card statement. And this charge is not a small amount.

Moreover, banks use (or at least seem to use) a super-complicated way to calculate interest on credit cards.

So today, I thought of simplifying that for you.

There are 2 simple infographics below, which will show you how the credit card cycle works, how interest is calculated and why missing one single payment can easily cost you a few thousand rupees.

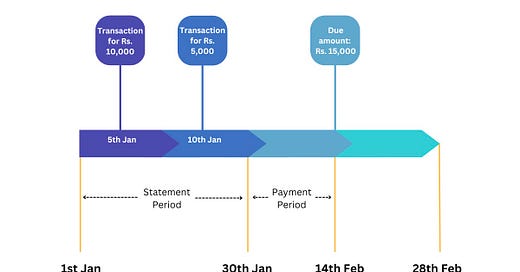

Let’s start by assuming that you have a credit card with the below timeline:

Statement period: 1st January to 30th January (basically 1st to 30th of every month). This means that all your expenses for the month (from 1st to 30th) will be billed and your statement will be generated on the 30th of the month

Bill payment due date: 14th February. You get a 15-day period to repay the bill that’s generated, so 14th Feb is the last date to pay your dues for January.

(Well if you’re married/in a relationship, you’ll have some more payments coming up on 14th Feb, but that’s a story for another day 😁)

Now, assume you do the below transactions on the said dates:

Here, you have different options to repay your bill.

Option 1: Pay the bill on time

Let’s assume you’re a good boy/girl when it comes to managing money.

In this case, you don’t have to pay any interest, because you paid your dues before 14th Feb, so the bank won’t charge you for it.

Now, let’s go ahead..

Option 2: Pay the bill in full after due date

Hmmm, if you’re not prudent with your finances (or miss paying it on the due date for some reason), then the bank pounces on the opportunity and starts charging you an interest for it.

Most folks just let it go, because it’s complicated to understand how the interest is calculated.

But it isn’t.

Here’s an infographic that shows how interest is calculated when you pay your bill late:

You see, if you pay your bill late, you’re charged interest not just for the number of days that you’ve delayed your payment, but for the entire duration - right from the date of the transaction till the date of payment. For each damn transaction.

Plus a late payment fee.

That’s why we keep screaming - Credit cards are great, but PAY YOUR BILLS ON TIME!

Option 3: Now, what if you pay the minimum payment amount?

Naah, you’re still screwed.

So the bank won’t charge you a late payment fee because you’ve made some payment.

But the late payment fee isn’t the monster. The interest charge is.

Below is an infographic to show how interest is calculated if you make a partial payment before the due date and then pay later when you have the money.

Here too, you’re charged interest for a loooong duration.

Basically, whatever debt you’ve kept with you, the bank charges you an interest for it. Till you pay the entire bill.

So even a one-day delay in paying the bill means that you’ll have huge interest charges. Because the interest will be calculated for each transaction - From the transaction date till the payment date. Not just for one day.

And the interest amounts are rarely small.

Which is why - Pay your bill on time.

A bonus tip if you forget to pay your bill

Well, we’re only human. And this means we may forget to pay our credit card bill at times.

And then when we realise that it was due, it’s too late.

But mostly, it isn’t.

You see, some banks have a 3-day provision for the money to hit their account. So if your due date is 14th Feb but you pay it by 15th or 16th, they mostly won’t charge you for it.

But that’t not the case with all banks. A lot of them will still charge you even for a 1-day delay.

But then too, you can call them up/email them and request them to reverse the interest charges. Most probably, they will (as long as it’s just a 2-3 day delay). It’s happened with me a couple of times, and except one bank, all the others have obliged and reversed the interest charges.

(Well, a credit card customer is a cream customer for the bank. They won’t want to piss you off just because you made a human error)

But like I said, it’s better to pay them on time and avoid the hassle. Set up standing instructions or use reminders. But make sure you pay bills on time.

A favour?

I spent a lot of time making this infographic to simplify the entire concept. So if you found it useful, I’d love it if you could share this post on LinkedIn and tag me (Ankur Jhaveri). This newsletter has 10,276 subscribers as I’m writing this post, and I hope to reach 11,000 this month. Your share will really really help.

Have a lovely week ahead!

PS: For some of you, this email may have gone in the “promotions” tab in Gmail. Please drag it to Primary and click on “YES” when Gmail asks “Do this for future messages from bizfin.substack.com?” Else you may end up missing the email!