Yes yes, I know! Everyone talks about investing in products that “beat inflation”. But today, we’ll talk about why the government-declared inflation figures may actually be irrelevant for people like you and me.

Before that, a small announcement!

We’ve started a YouTube channel for people who prefer video over reading. And this article is uploaded as a video on YouTube too, so if you prefer watching, check it out HERE. Make sure you subscribe to the channel and hit the bell icon (Also, please like the video so that it reaches more people) 😁

Now, if you prefer reading, go on..

What is inflation?

(If you know what inflation is, you can skip straight to the next section)

Simply put, if something cost Rs. 100 last year and it costs Rs. 105 this year, it is due to a phenomenon known as inflation - The rise in prices for products and services in general, is known as inflation. As of writing this article, inflation is around 7-8% in India. That means, in general, prices of products or services increases by 7 to 8% every year.

Inflation and your investments

Now, a lot of people say that investments should be done in a way that they beat inflation. That you should get at least inflation plus 3-4% returns. Otherwise your money is losing value. And that’s why FDs are not recommended, because FD returns are only around 4-6%, when the inflation is 7 to 8%.

But this “inflation” benchmark itself is the wrong benchmark to keep.

To understand why, you need to first understand how inflation is calculated. Pay attention here, because only after you understand this, will you understand why inflation may be the wrong benchmark for you.

How is Inflation calculated?

So to calculate inflation, we use the “basket of goods” approach.

Basically, when the government calculates inflation, they create a hypothetical basket with certain products and services that are most commonly used. So things like auto fare, taxi fare, movie tickets, mobile phone cost, fruits and vegetable cost etc. are considered in the basket.

Now, depending on how important each of these products is to a daily consumer, weights are assigned to each of these products. And based on the weights and the prices of these items, an indicator is calculated, known as the Consumer Price Index.

Now let’s not get into how CPI is calculated; it’ll just unnecessarily complicate things. It’s just sufficient to understand that based on the most commonly used products and services, their weights and their prices, an indicator called CPI is calculated.

(Okay if you want to know more about CPI calculation, just comment on this article or send me an email and I’ll share an article with you)

Now every month, this CPI calculation exercise is done, and the difference between the CPI for any month and CPI for the same month in the previous year is expressed as a percentage, and that percentage is known as CPI inflation.

To give you an example if the CPI in September 2021 was 100 and CPI in September 2022 is 108, there is an 8% inflation this year.

Like I said, every month, these inflation numbers are calculated and declared by the government.

Why could inflation numbers be irrelevant for me?

Now you’ll ask “Ankur what is wrong with keeping inflation as a benchmark while investing?”

This is what is wrong:

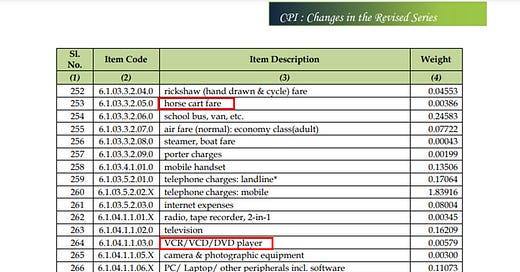

Below you’ll see a list of some of the items which are a part of the basket.

Check out the items highlighted in red - you’ll see horse cart fare, VCR and VCD players, tape recorders and what not. These are all a part of the CPI basket, and used in calculating the CPI.

Now just do this - recollect the last time you used a VCR/VCD player, tape recorder or a horse cart. For me, the last time I used a VCD player was more than 10 years ago. Right now, whether the price of a VCD/VCR player or tape recorder increases or decreases, it doesn’t matter. But this increase/decrease is a part of the inflation number.

Next, I’m sure you use earphones. Some of you may also be using iPads and tablets. And almost all of us use some subscription like Hotstar, Netflix, Prime etc..but ALL of these products are relatively newer products - not a part of the CPI basket.

Now, an interesting thing - “Beer” is also a part of the basket.

But to a non-drinker, it doesn’t matter whether prices of beer increase or decrease.

Okay guys don’t lose focus..reading about beer may distract you, but come back to the article - we’ll be done in exactly 2 minutes!

And here’s the problem. The CPI basket is made for the “average” population. So rural India still uses horse carts, but it’s completely irrelevant for us. And same way, a Netflix subscription is important to us, but it doesn’t exist in the basket.

Then there’s another third problem - The inflation basket has items such as house rent. But if you just don’t stay on rent, then whether the rent increases or decreases is irrelevant for you. But the basket still assigns a weight of 9% to house rent, which is a pretty high proportion, and it means their calculation of inflation could be very different from what is applicable to you if you don’t stay on rent!

Now don’t get me wrong. I’m not saying that CPI calculation is incorrect. It’s probably done well. But what I’m saying is - Inflation is calculated for the ECONOMY as a whole, and not for you or me as an individual. Now just imagine, if Netflix increases their prices, won’t you have to pay more? But such increases are just not accounted for in the average inflation figure!

THAT is the problem. Since YOUR inflation may be very different from the economy’s inflation, you can’t say for sure that if your stock or mutual fund returns beats the inflation percentage, it’s a good investment. Maybe it isn’t. Because without knowing your “personal” inflation, you won’t know how much to beat!

How to actually calculate your personal Inflation?

Now if you want to know your personal inflation, the easiest way to do it is to take your bank statements for every month and calculate the total outflow of money. Do it for all months for, say, the past one or two years, calculate the increase and then calculate your personal inflation.

This again, may not be 100% accurate because there are a LOT of variables. But it’ll still be better than keeping the economy’s inflation as a benchmark.

Well guys, that’s it for today. Let me know how you liked this piece. And please don’t forget to check out the YouTube channel and like, share, subscribe! 😁

Hey Ankur, profound article. Waiting to read about CPI calculation and would be great if you could write about what are the other inflation indices used and other insights around them.

Thanks for the work :) keep doing !

Can you share CPI calculation article please.