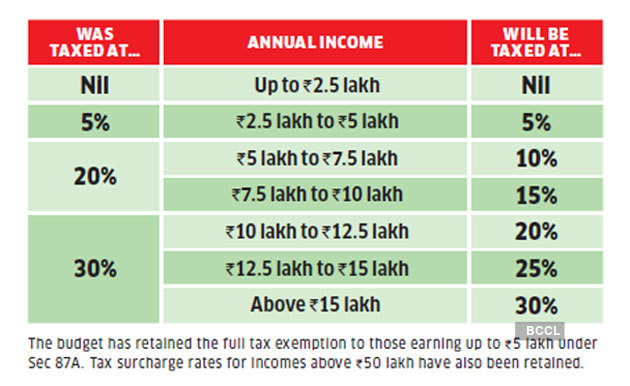

Old v/s New Tax Slabs

Long time, no see! Sorry about the brief period without the newsletters!

We’re finally back!

So it is that time of the year when we are going to submit our investment proofs and subsequently file our returns. That time of the year when the final tax amount would be deducted from our salaries.

It is therefore, that time of the year when we will make tax-saving investments so that we don’t end up getting peanuts as our salary in the month of March.

This post will, in 2 minutes, show you the new and old regimes for paying Income tax, and also discuss if there is any best mode for you based on your income range.

Before that, if you want to know how you can save up to Rs. 82,500 in taxes, read the post on tax saving here.

Let’s begin.

There is the old regime, and the new regime for paying Income Tax. It is up to the individual to opt for any regime, based on his/her taxable income. It’s the individual’s choice.

Both slabs are as below.

Please note that the annual income shown above is the Taxable Income, and not the CTC of the individual.

What is taxable income? It is the income of the individual after deducting all components like HRA, LTA, food allowances etc (which are exempt from tax) and your investments which can be claimed as a deduction under the Income Tax Act. The income after all of this, is the income you actually pay tax on, and is therefore called your taxable income.

[Read the post here about all the investments you can make to save tax]

Now comes the question - what is the difference between both slabs, and which slab should you choose?

As to the difference in slabs, as per the earlier slab, the rates are relatively higher for some income ranges, but the difference here is that you can claim deductions and exemptions if you opt for the old slab. So, like mentioned above, HRA, LTA etc can be claimed as exemptions and investments under Section 80C, 80D etc can be claimed as deductions, post which your taxable income is taxed.

If, however, you choose the new slab, you cannot claim any deductions or exemptions, and your total income that you get in your bank account becomes fully taxable.

So basically, if you are making investments under various sections, or claiming rent and LTA etc., you might want to opt for the old regime. If, however, you are not making any investments, the new regime may work better for you.

However, here’s a disclaimer: You will need to first calculate your actual tax as per both regimes and then decide which regime you need to opt for, since depending on your income range and subsequent slab you fall under, what kind of investments you make etc, your tax will change. This will vary from individual to individual, and hence is difficult to choose a winner here. I’m sorry, but you’ll have to do some manual work before you decide which slab to choose.

You can have a look at the sample Income Tax calculator on the official website here.

In case you have questions, please shoot it in comments, or reach out to me on ankurajhaveri[at]gmail[dot]com

If you’ve not yet subscribed to the newsletter, please do it by clicking the button below. You’ll get periodic updates on personal finance topics like the one you’re reading right now.

Oh, and if you think this post helped you understand personal finance, please share this newsletter/link with your friends on e-mail, Linkedin, Facebook, or Twitter. These shares give me a lot of motivation to write more! :)

PS: The newsletters may go to the “Promotions” or “Updates” tab in Gmail. Please drag the mail to “Primary” and click on “YES” when Gmail asks “Do this for future messages from Substack?” so that you don’t miss these e-mails.