Lightning fast way to choose tax regime!

In ONE minute!

Hey! So today’s newsletter is going to be extremely short!

I’ll just be talking about both tax regimes and how you can select which one works best for you!

But first, how are both regimes different?

Simple:

In the old regime you can claim more deductions and exemptions. In the new regime, you can only claim Standard Deduction (of Rs. 50,000)

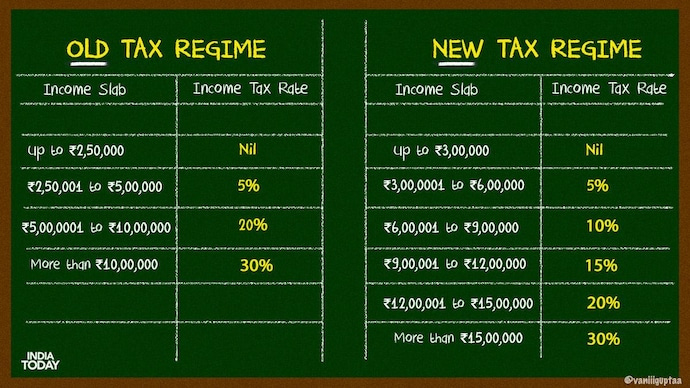

The tax slabs for both regimes are different, as below:

In the old regime, if your net taxable income is <= Rs. 5 lakhs, you have to pay zero tax. For the new regime though, you have zero tax if your net taxable income is <= Rs. 7 lakhs

Okay, so which one works better?

Honestly, you’ll need to calculate which regime works better. For that, I’ve shared a link HERE as well as towards the end of the email. It has a calculator where you can input a few details, and it’ll tell you which regime works best for you!

Note that you won’t be able to edit the sheet on the drive. You’ll have to download it on your local computer and then edit it. Please don’t request for edit rights, as it will mess up the sheet if someone starts editing it online.

Is there a faster way to do it?

Yes. There is!

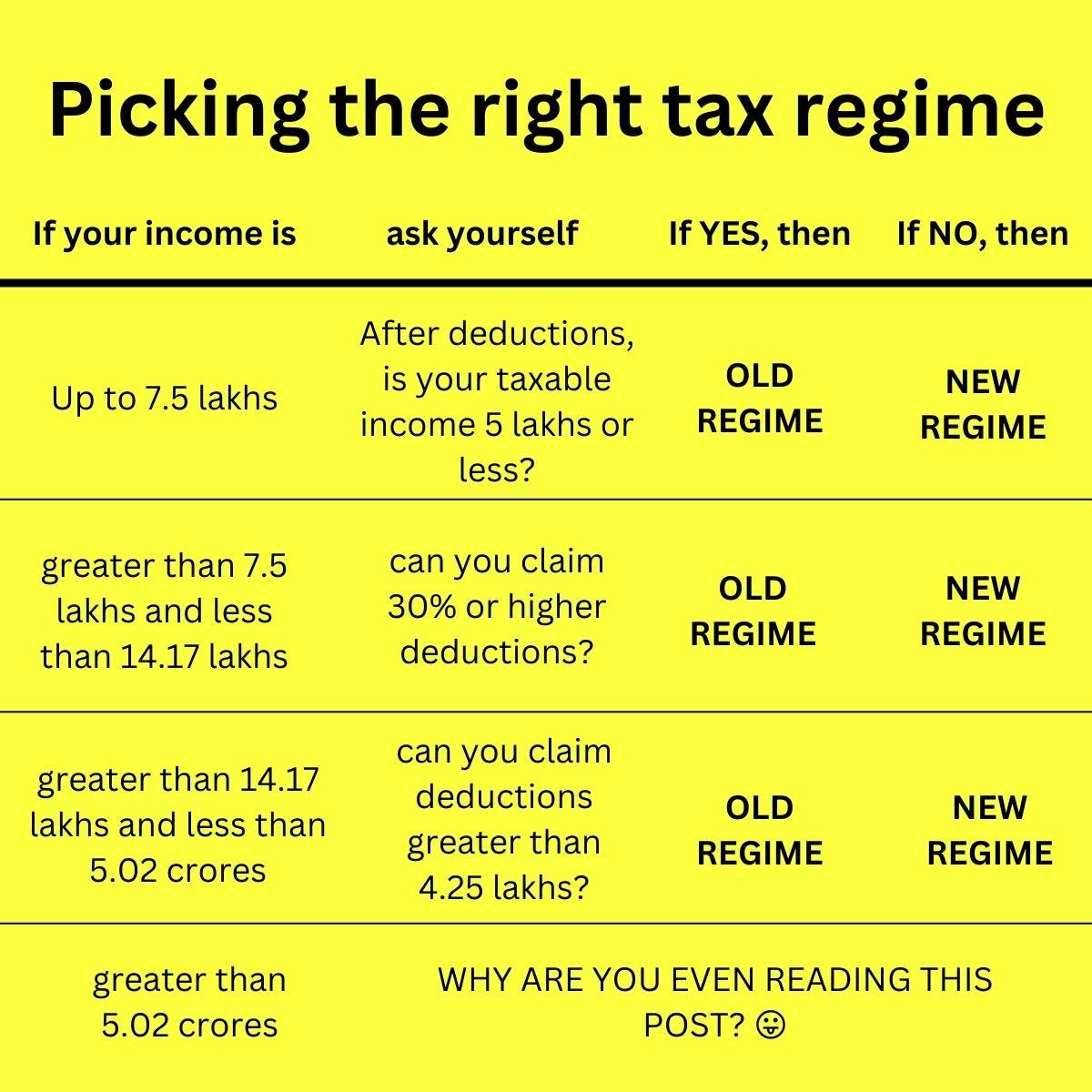

I found two nice hacks using which you can mentally calculate which regime works better. Here’s one way to do it:

This works if you know the total amount of deductions that you’ll be able to claim, so then you can calculate which regime works better.

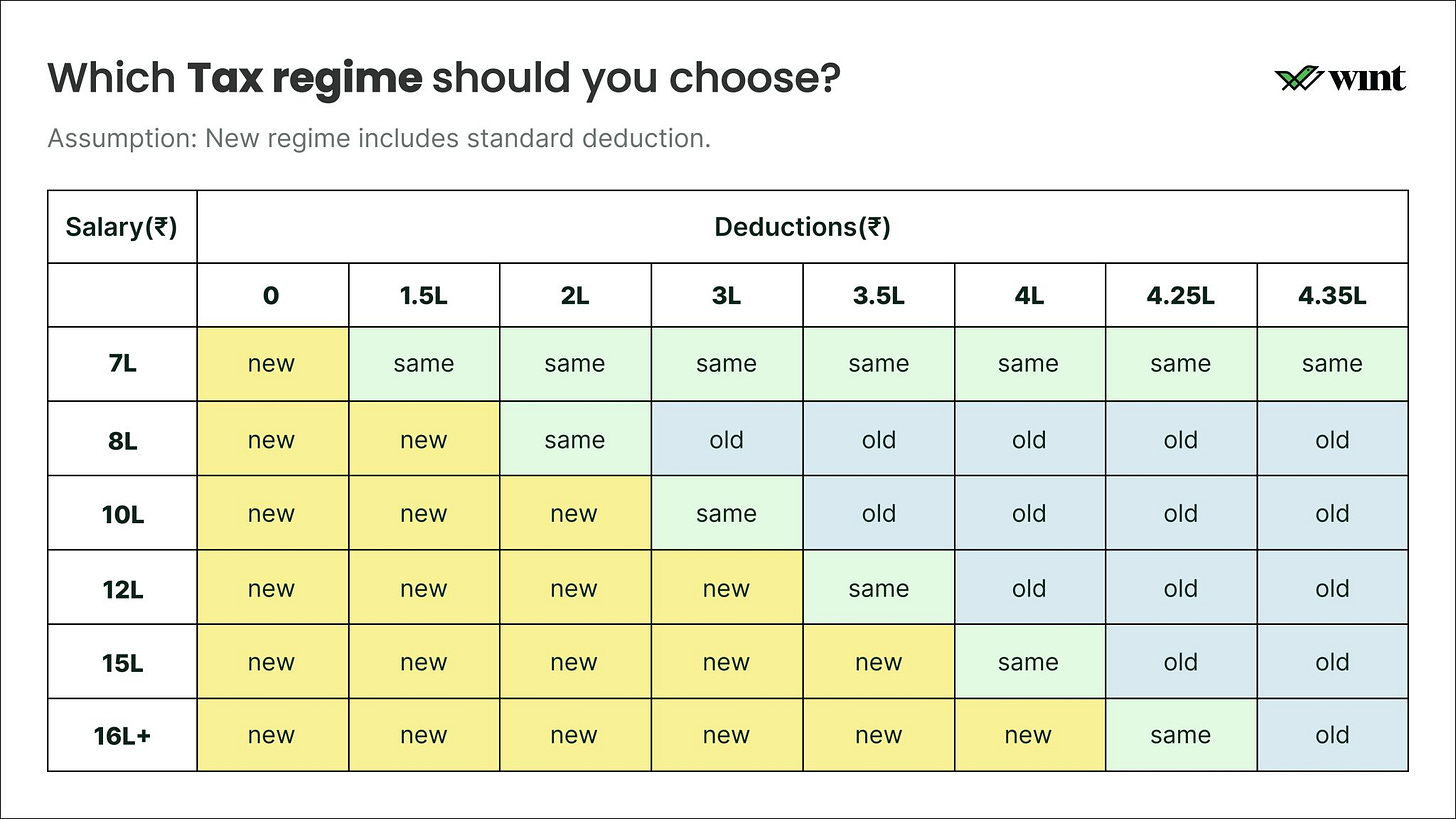

And if you’re flexible with the deductions, you can back-calculate the amount of deductions you will need to claim if you want to save tax by opting for the old regime. This way:

Okay, so if you want to calculate the numbers?

HERE is the excel sheet that you can download and input your details. This will give you a more accurate answer (and will be faster for some folks). However, like I mentioned earlier you won’t be able to edit the sheet on the drive. You’ll have to download it on your local computer and then edit it. Please don’t request for edit rights, as it will mess up the sheet if someone starts editing it online.

(In the sheet, go to File → Download → Microsoft Excel)

That’s all folks! Don’t stress about taxes. This article will make it as easy as using a simple calculator!

Feel free to reach out to me on email (or comment on this post) in case you have any questions!

Oh, and if you liked this article, please SHARE it with friends who need it! It’ll mean a lot to me! ☺

Also, if you’re not a subscriber to this newsletter, click the button below and subscribe, so that you don’t miss out on tools like this, and start managing money better!

Ankur, I wanted to take a moment to express my sincere gratitude for the time and effort you put into explaining the tax regime to Us. Your explanation was so clear and easy to understand, which helped me gain a better understanding of how taxes work and how they impact my finances.

Your expertise and willingness to help others is truly appreciated. I am grateful for your patience and dedication to helping me understand this complex topic.

:)