Hey there!

Okay, not 84 years, but it’s been a while since I wrote a newsletter to you guys! Almost a year (the last one was in January).

So for those of you who’ve been following me since a while, I took a break from this newsletter. No I wasn’t burned out, rediscovering myself or anything else that creators say to make them sound cool.

It was just a lack of time. And maybe definitely discipline. 😛

First, my job kept me super busy. Add to that the 2 hours of travel everyday (well, Mumbai 🤷🏻♂️) and I hardly get time for personal stuff.

Next, as some of you know, I recently bought a home (yeah, I’m one of those rare finance creators who bought a house - more on that later). And trust me, buying a house is easy, building it is tough. So my weekends are spent on dates with the interior designer, the carpenter, the plumber and the electrician 🥲 giving me no time to write.

But now I’m finally back! And I already have a list of super interesting topics I plan to write on 😊

Now, for those who signed up recently, this newsletter is all about money, startup ecosystems and business. Yeah, all the high-adrenaline, growth stuff.

I’ll be writing one email a month going forward. Today, I write about How to go beyond those Moneycontrol rankings and choose a high-return mutual fund that caters to YOUR requirement.

As usual, I’ll try and wrap this up in 5 minutes.

So…

Now, I’ll tell you the process I follow to select a mutual fund, and you can use similar a approach if you’d like.

1. First, what’s the objective?

Very basic, but absolutely essential - You ask yourself - What’s the objective of your investment?

If you’re investing for a goal, how far off is the goal? There’s no straight rule, but here’s what I follow:

However, do note that simply having a 7+ years horizon doesn’t mean you should invest in small or mid cap funds. They’re inherently riskier than large caps, so if you don’t have the risk appetite, don’t do it. Stick to large caps.

Okay, so we’ll assume that you want to invest in an equity fund and go ahead (Well, otherwise I won’t be able to complete the email in 5 minutes)

2. Now, start with ranking

Okay, so while the rank should not be the only criteria, it gives you a good place to start if you have a blank slate. Check the top 2-4 funds and then do a further deep dive. Else, you can also take recommendations from a friend and then start analyzing those funds.

I’d say don’t go below the top 10. But again, no hard and fast rule.

3. Then, the basics

You want to start by covering the basics of the mutual fund:

The past returns of the fund should be high and the expense ratio should be low. Generally, people see both of these in isolation. But I see them together. It’s simple, really. If a fund is giving me higher-than-normal returns, I don’t mind paying the fund manager a higher-than-normal expense ratio. Of course, needless to say, if you’re doing this on your own and don’t know a mutual fund advisor/distributor, choose a direct fund to save on the expense ratio (although I always recommend going with an advisor while starting)

I do a basic check on the fund manager. After all, they’re the ones actually taking the decision about your money, right?

You can get the details of the fund manager in the fund factsheet or the mutual fund website. What I see is the below:

Their track record should be good

Their other funds should also be doing well

The fund manager shouldn’t have changed very frequently for this fund

AUM: For those who don’t know, AUM is the total amount of money that investors have invested in this particular mutual fund. I just check two things here:

The AUM shouldn’t have suddenly increased or decreased

If the AUM of this particular mutual fund forms a significant portion of the overall AMCs mutual funds in the category, then this is a pretty significant fund for them. This means they won’t screw up (or will try their best not to 😛)

4. Finally, the complex shit - The ratios

Well, this is the final part of the analysis I do while shortlisting a mutual fund. There are hundreds of ratios that give you a picture of how the mutual fund is doing. You really don’t need to check so many of them though. It’s an overkill.

I personally just check 3-5 of them, which I’ve explained below.

Before delving into the ratios though, you should know the concept of the benchmark index, which is essentially a collection of stocks that shows how a particular section of the market is doing.

For example, the benchmark for a small cap mutual fund will be Nifty small cap 250 Index - which is a collection of 250 small cap stocks - used as a reference point to compare the performance of any small cap mutual fund against a broader market.

The concept of benchmark is important here, because most ratios will compare the mutual fund return with its benchmark. If you want to know more about benchmarks, read them here.

Now, coming back to the analysis - Here are the ratios I check while choosing a mutual fund:

Alpha: This basically tells me how much additional return the mutual fund is giving me compared to the benchmark. An alpha of zero means the fund is giving return equal to the benchmark. An alpha of 2 means your mutual fund’s return is 2% more than the benchmark.

Your alpha should ideally be high, so that you get better returns compared to the benchmark.

But if only life was so easy!

Generally, a high alpha comes with a high risk too. And the 2 ratios below help indicate the risk of the mutual fund.

Beta: This shows how volatile the mutual fund is compared to the benchmark. A beta > 1 means that the fund is more volatile than the benchmark. A beta < 1 indicates less volatility compared to the benchmark and beta = 1 means the fund is as volatile as the benchmark index.

Now, it’s not necessary that you should have a low beta always. If a fund has a higher beta, it means you’re taking more risk to get more returns. Which is fair.

Standard Deviation (SD): This talks about how volatile the mutual fund is with respect to its own average return - Basically how much it deviates from its own average return. Similar to beta, a high SD should be evaluated against the alpha that the fund is generating. The volatility (risk) should be worth the returns.

Now, apart from these 3, “the Risk & Rating” section of MorningStar gives me some really good data points that help me understand how a mutual fund is performing. And no, this isn’t a paid post (although I do wish companies would pay me for doing this 😛)

Capture ratios: These talk about how well the fund is performing wrt the benchmark in upward and downward market trends.

Upside capture ratio indicates how the fund is performing when the benchmark is high.

For example, an upside capture ratio of > 100 means that when the benchmark is giving positive return, this mutual fund has given better returns compared to the benchmark.

Downside capture ratio indicates how the fund is performing when the benchmark is low

For example, a downside capture ratio of > 100 means that when the benchmark is giving negative return, this mutual fund has given even worse returns compared to the benchmark.

So ideally, your upside capture ratio should be >100 → higher the better; and your downside capture ratio should < 100 → lower the better

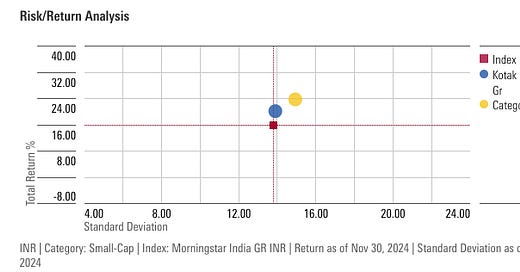

Risk-Return scatterplot: This is a neat graphical representation of the risk vs reward analysis for a mutual fund. For example, if I pick Kotak small cap fund, MorningStar has the below Risk-Return graph:

As you can see, Kotak small cap has given higher return than the benchmark index (while taking almost the same amount of risk - which is pretty good).

This graph gives a nice representation of the risk vs reward scenario we spoke about earlier.

In addition to the 4 steps for analysing equity funds, I also glance through the holdings to see what % of the fund’s money is invested in small/mid/large caps and which are the major stocks the fund is holding.

So, that’s it!

This is all I do when I’m choosing my equity mutual fund. It’s not that complex, really.

The process for debt funds is very different though, so let me know if you’d like to understand that as well. I’ll probably write another newsletter on that (although I don’t invest much in debt funds myself. I’m still young (and not very rich) you see 😛)

With this basic analysis, I go ahead and invest in the selected mutual fund.

And then I wait. For a bull market 😁

What next?

If you’re not already, do connect with me on LinkedIn. I keep posting my learnings of startups, money and the economy in bytes there

As promised, I’ve spoken about buying a house here. Do give it a read! Also let me know if you’d like me to write a detailed email on the steps to buy a house, what to look for and how to plan finances :)

If you liked reading this or if you have any further questions, I’d love if you could reply to this email and let me know! Happy to write topics that you’d be keen on reading, so let those suggestions keep coming! 😁

Very informative post! I liked the point about aligning mutual fund goals with personal financial goals. Many people miss that step. Subscribed for more content like this.