As an investor, I’m sure you’ve heard that equity investments should always be considered for the long term. But how long is this long term?

People put a random number of 5+ years for equity investments, but is there any backing or study for it?

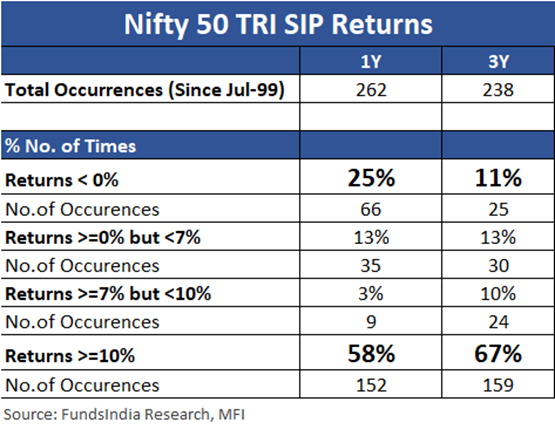

Today, we’ll look at a study done by Funds India, where they evaluated Nifty50 returns of monthly SIPs which were started at the beginning of every month (i.e 1st July 1999, 1st Aug 1999 etc), till July 2022. And the returns were analyzed for various time periods (1 year, 3 years. 5 years, 7 years)

Let’s look at them one by one.

1-year timeframe

Over a 1-year timeframe, there were 66 occurrences (out of 262 total occurrences) where the SIP portfolio gave negative returns. That means if you invested for a year, 25% of the times the equity portfolio gave negative returns

3-year timeframe

Over 3 years, 11% of occurrences gave negative returns

Verdict: 1-year and 3-year timeframes had quite a few possibilities of negative returns, and therefore they should not be considered ideal timeframes for equity investing

5-year timeframe

When seen over 5 years, there was only ONE instance when the returns were negative. That means only 0.5% of the times, the portfolio gave a negative return. Also, 76% of the times, the portfolio gave returns of over 10%

However, 10% of the times, the returns were between 0 and 7%, (which is low for an equity investment)

Okay, while 5 years seems like a decent timeframe, could we do better?

So the FundsIndia team went on to analyze the 7-year timeframe.

What would happen if a portfolio is held for 7 years?

7-year timeframe

Now over 7 years, there were ZERO occurrences of a negative return. This means no matter when you invested in this time period, if you held it for 7 years, you would have got a positive return.

But how much?

Well, 78% of the investments earned returns higher than 10%, and only 3% of the investments earned mediocre returns (less than 7%)

So it’s quite clear that while 5 years is the bare minimum duration you should consider before you start investing, taking a 7-year timeframe gives you better chances of making higher returns.

And data showed that even if the markets fall within that timeframe, 7 years is long enough for the market to recover.

But what if the market falls after 7 years?

Great question. What if you held on to the investment for 7 years and the market crashed at the end of your investment horizon?

Well, again, data showed that if you simply extend the investment horizon by another 2 years, your returns will again bounce back to 10% +

Now I know that extending your horizon by 2 years is easier said than done, but that’s how it has worked in the past.

In a nutshell

If you’re looking at equity investments, a 5-year timeframe and a 7-year timeframe have a >75% chance of giving decent returns, with a less than 1% chance of earning negative returns.

However, you also have a higher probability of earning mediocre returns (less than 7%) if you opt for 5 years. To be on the safe side, 7 years is a good consideration, but I could live with 5 years too!

If you liked this piece, why don’t you share it with friends and tell them how long they should stay invested in the equity markets?

And if you’re not reading this on email, why don’t you subscribe to receive weekly newsletters like this that help you manage your money better?

Oh, and please drop in your thoughts in the comments section or by replying to this email. I love interacting with our fellow readers! 😁

See you next week!

Ankur, congrats and thank you for writing well-thought articles. Your articles are spot on and no-nonsense types. Keep it up.