Did you know that you can save Rs. 82,500 in taxes?

We just filed our Income Tax returns a few days/weeks back. And in the next 2 months we need to complete our investments for the current financial year as well; so I thought I should write about ways in which we can save the tax that we pay, AND earn some interest on it - basically instead of paying tax to the government, you invest that money in places which give you tax exemption, AND that money works for you.

Like I always say, this is just a 5-minute post, so everybody can go through it; but if you think you’ve mastered your tax planning and are really busy, you may skip reading!

This article will tell you about the different ways you can invest to save tax.

So let’s begin!

Section 80C: We all know about the 1.5 lakh investment we can make under section 80C. In case some of you don’t, Section 80C of the Income Tax Act 1992 allows you to invest your money in certain instruments (for simplicity, we will call instruments as “products”), and you don’t need to pay any tax on the amount you invest in these products. So basically, your taxable income, now gets reduced by Rs. 1,50,000 (if you utilize the full amount) because you invested in certain products under section 80C. These products are ELSS Mutual Funds, LIC plans, Provident Fund (mind you, the PF contribution that you do every month, which is mentioned in your salary slip, also counts towards this 1.5 lakhs), Tax Saver Fixed Deposits, NSC etc. If you have a home loan, the principal you pay towards the loan can also be considered under this section. Also, your children’s tuition fees are deductible under section 80C.

We’ll explain the above products in later posts, but for now, let’s focus on overall tax planning. Basically, Section 80C can reduce your taxable income by Rs. 1.5 lakhs, which means, depending on your tax slab, you can save anywhere between Rs. 7,500 and Rs. 45,000 which you’d otherwise pay as tax, with the help of 80C investments.

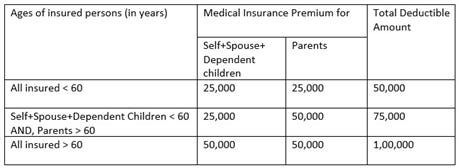

Next comes Section 80D. This has to do with your mediclaim payments. If you don’t know about mediclaim, you can read about it here first. Please note that a Term Insurance premium is covered under section 80C and Health Insurance/Mediclaim is covered under section 80D. Now here’s the catch - most people don’t utilize this fully. The limit for this section is Rs. 75,000 overall. There are sub-limits though, which are Rs. 25,000 for self and family and Rs. 50,000 for parents (age above 60) or Rs. 25,000 (age below 60).

Confused? Don’t worry. We’ll simplify it for you!

What this means is that you can claim the premium you pay towards a mediclaim policy for yourself, your spouse and your kids as a tax deduction. The maximum amount of premium you can claim is Rs. 25,000 (irrespective of what your actual premium is). Most people claim this and let it go. But here’s the thing - if your parents have health insurance, you can pay the premium for them and claim that too as a deduction under the same section 80D. The maximum premium you can claim for your parents is Rs. 25,000 if they are below 60 years of age. If they’re senior citizens (above age 60), then you can claim the premium paid up to Rs. 50,000.

Still confused? Here’s a table to simplify it further:

Now here’s another catch - you can also claim the money you pay for preventive health check-ups, for yourself, your spouse, your kids and your parents. But the total limit for this is Rs. 5,000; and it should fall under the above limits of Rs. 25,000 (self+family) and Rs. 25,000/50,000 (parents). Basically, you can claim a TOTAL deduction of Rs. 5,000 towards diagnostic tests as long as the individual limits are not breached.

Let’s take an example - if you are paying a premium of Rs. 25,000 towards yourself and family, and a premium of Rs. 40,000 towards senior citizen parents, and you have spent money on tests worth Rs. 2,000 for yourself and 3,000 for parents, you can only claim Rs. 3,000, since your parents’ premium is below the 50,000 limit. You cannot claim the Rs. 2,000 you spent on yourself because your premium is Rs. 25,000, which is the maximum allowed limit. However, you can claim another Rs. 2,000 if you do diagnostic tests for your parents, since they still have room for another 7,000 (Premium - 40,000 | Health check-up 1 - 3,000). However, you’ll need receipts for all of this to prove that you actually spent the money you are claiming.

Confused again? Don’t worry. This example will clear it out for you! (This considers that your parents are senior citizens, above 60 years of age)

So by utilizing your 80D provisions well, you can reduce your taxable income by up to Rs. 75,000, which means, a net tax saving of (depending on your tax bracket) Rs. 3,750 to Rs. 22,500! Most people claim their own premium payment and claim nothing for their parents’ premium or any diagnostic tests. Well, now in 2021, you should!

Lastly, there’s an additional Rs. 50,000 that you can invest in the National Pension Scheme (NPS) and claim a deduction. NPS actually also falls under the limit of Rs. 1,50,000 that we discussed in point 1 (under section 80C), but there’s a provision in the Income Tax Act, which allows you to invest an ADDITIONAL Rs. 50,000 in NPS under section 80CCD(1B) and claim it as a deduction.

With this additional contribution, again, depending on your tax slab, you can save anywhere between Rs. 2,500 to Rs. 15,000 just by investing money in NPS.

Now let’s do the math.

If you fall in the 5% tax bracket and utilize the sections well, you can save Rs. (7,500 under 80C + 3,750 under 80D + 2,500 under 80CCD(1B)) = Rs. 13,750.

Now, if you fall in the (un)lucky 30% slab, here’s how much money (tax) you save:

Rs. (45,000 under 80C + 22,500 under 80D + 25,000 under 80CCD(1B)) = wait for it……Rs. 87,500!

And we’re not even considering how much returns the investments under 80C and 80CCD(1B) will give. Even at an 8% per annum return, this will double in less than 10 years!

So while most of us try to spend less or save more, a lot of us still don’t pay attention to smart tax planning, which can save us a decent sum of money for a good vacation, or an iPhone or even that bike you’ve always wanted to buy! ;)

I hope this article helps you plan your taxes smarter, and get that vacation, iPhone or bike sooner. If you have any questions on any topics we have discussed, please feel free to get in touch with me on ankurajhaveri[at]gmail[dot]com.

If you’ve not yet subscribed to the newsletter, please do it by clicking the button below. You’ll get periodic updates on personal finance topics like the one you’re reading right now.

Oh, and if you think this post helped you understand personal finance, please share this newsletter/link with your friends on e-mail, Linkedin, Facebook, or Twitter. These shares give me a lot of motivation to write more! :)

PS: The newsletters may go to the “Promotions” or “Updates” tab in Gmail. Please drag the mail to “Primary” and click on “YES” when Gmail asks “Do this for future messages from Substack?” so that you don’t miss these e-mails.

Hey Ankur. I am a tax resident in India. I have always avoided parking funds I tax saving instrument thinking it will block the fund if I have to leave India. Suppose I hit ceiling of all deductions and claimed tax deduction and the next year, I am to.leave India by liquidating(Elss), how does it work?