Okay, today I’m going to give you a hack to calculate ANY kind of EMI mentally, in less than 3 seconds! 😎

Yup.

If you plan on buying a car, for example, and know the loan amount you’ll be taking, you can mentally calculate the EMI in no time, without the need for a calculator, or worse, an annoying excel sheet!

(Well, you have to be decent at math though; if you’re anything like I was in childhood, you may need more than 3 seconds 😛)

Before I tell you the hack though, here’s a disclaimer - This will give you a range, not the exact value. But the range is enough to give you a start!

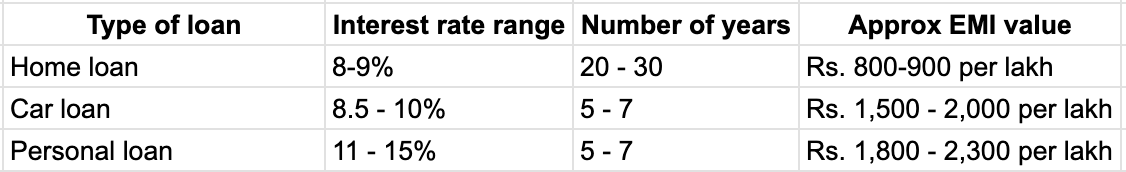

So here it is, for the 3 major types of loans

1. Home Loan

Here, for every lakh that you borrow, you’d be paying an EMI of Rs. 800-900.

So if you buy a house that costs Rs. 1.2 crores and make 20 lakhs as the downpayment, this means you’ll borrow 1 crore, which in turn means you’ll be paying an EMI of Rs. 80,000 to 90,000 (800/900 per lakh x 100 lakhs)

So depending on your interest rate and tenure, your approximate calculation will remain the same, and the EMI will be in the range of 80-90K.

Now, let’s say you want to buy that fancy SUV. Here’s how that calculation goes.

2. Car Loan

For car loans, the duration is typically between 5 to 7 years and interest rate is between 8.5 and 10%.

So here, for every lakh that you borrow, you’d be paying an EMI between Rs. 1,600 to 2,100.

So, that 15 lakh car for which you make a down payment of 5 lakhs and take a 10 lakh loan, will give you an EMI in the range of 16,000 to 21,000 every month. Again, the exact amount will depend on the rate of interest and duration, but will typically lie in this range.

3. Personal Loan

Now, God forbid you need to take a personal loan. I hope you never have to, but just in case you do, the interest rates are crazy.

A personal loan can have an interest rate of anywhere between 10% and 25% (or more) depending on your credit score and other things. But I’m going to assume that since you are a subscriber of this newsletter, you’re good at your finances and have a decent credit score (otherwise, what are we even doing here? 😛)

So, let’s assume that if you ever take a personal loan, it’ll be in the range of 11-15%.

For this kind of interest rate, with duration between 5 and 7 years, the EMI per lakh will be in the range of Rs. 1,800 to 2,300.

So if you borrow Rs. 10 lakhs, you’ll end up paying about 18-23K per month as EMI.

Like I said, I hope you never have to take a personal loan, but in case you do, you know how much you’ll have to pay for it.

In summary…

I’ve made an excel sheet HERE where you can simply key in the loan amount and select the type of loan, and the calculator will tell you your approximate EMI.

So go ahead, plan your finances mentally and show some flex to your friends while telling them about loans and EMIs! 😉

But hey, if you actually found this useful, please also share the article with friends & family who are considering taking a home, car or personal loan, so that it helps them too!

See you next week! Let me know if you liked today’s piece! 😁

Hey Ankur, I wanted to express my appreciation for your consistently insightful newsletter. Your content is incredibly valuable and always provides me with a wealth of helpful information. Thanks a lot for sharing your knowledge and dedication. Keep up the excellent work!

Good one